Fixed Income Investment Process

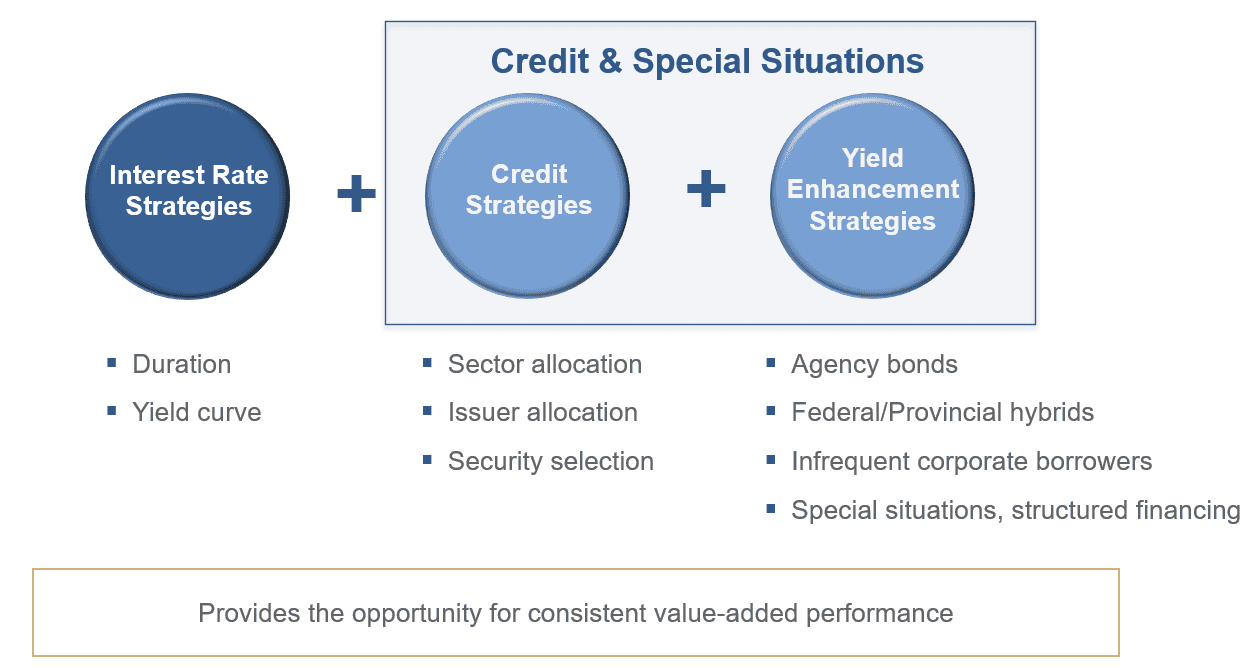

Our fixed income portfolios employ a multi-strategy approach, continuously evaluated in response to changing interest rate conditions and bond sector and individual issue valuations. Our deep fundamental credit research and unique credit process are key to analyzing credit and special situations, giving us a competitive edge.

Multi-strategy Approach to Fixed Income Investing

We apply these three broad strategies, adjusting them according to the economic and interest rate cycle. This combination is designed to deliver stable, consistent value over time.

Interest Rate Strategies

Duration

In order to effectively size our active duration position within our mandates, we incorporate three main factors into our investment decisions:

- Opportunity Size: We evaluate the potential for significant interest rate movements.

- Probability of Success: We estimate the likelihood of our forecasts being accurate.

- Volatility Impact: We aim to minimize unwanted portfolio volatility.

Yield Curve

Interest rate changes rarely impact the entire curve equally. We actively manage investments along the yield curve using strategies like:

- Exposure to bonds that have similar maturity dates

- Exposure to bonds with the maturities grouped around differing dates

- Exposure to bonds grouped by maturity date consistently across many time periods

Our yield curve strategy involves evaluating the economic and monetary outlook and its expected impact on all segments of the yield curve. By using specialized bond analytic tools such as PC Bond, we can look at yield curve changes at similar points in past economic cycles to help us project future changes.

Credit Strategies

Sector and Sub-Sector Allocation

Sector and sub-sector allocation involve a blend of top-down and bottom-up research. We identify sectors and sub-sectors likely to outperform based on our macroeconomic outlook and industry expertise, then evaluate their value and risk to determine optimal portfolio allocation.

Credit Rating

Our fixed income portfolio construction relies on a rigorous credit process and unique risk-based valuation tools to identify undervalued securities from high-quality companies. Our research leverages strong fundamental analysis to consistently deliver repeatable performance. By deeply understanding each business and its market fundamentals, we assess how a company’s financial management and structure impact its base business risk.

This process culminates in the FGP Investment Grade Rating (IGR), an internal rating that we compare to the market’s implied rating to identify valuation gaps. We then build a portfolio focused on securities that meet our risk criteria and offer the largest valuation gaps, the goal being to capitalize on market mispricings.

Yield-Enhancement Strategies

We enhance portfolio yield by identifying bonds with unique attributes often misunderstood by the market. This includes securities with unique structures, government guarantees, or those created through legislation. These bonds generally pay a higher yield than standard bonds and are selected based on our bottom-up credit research to ensure they have an appropriate risk profile.

Commitment to Responsible Investing

We fully integrate responsible investment (ESG) factors into our fixed income investment process. This integration ensures that our investment decisions align with broader environmental, social, and governance considerations.

Request An Introductory Call

Praesent Sapien Massa, Convallis A Pellentesque Nec, Egestas Non Nisi. Donec Sollicitudin Molestie Malesuada. Nulla Porttitor Accumsan Tincidunt.