FGP Core Plus+ Bond Fund

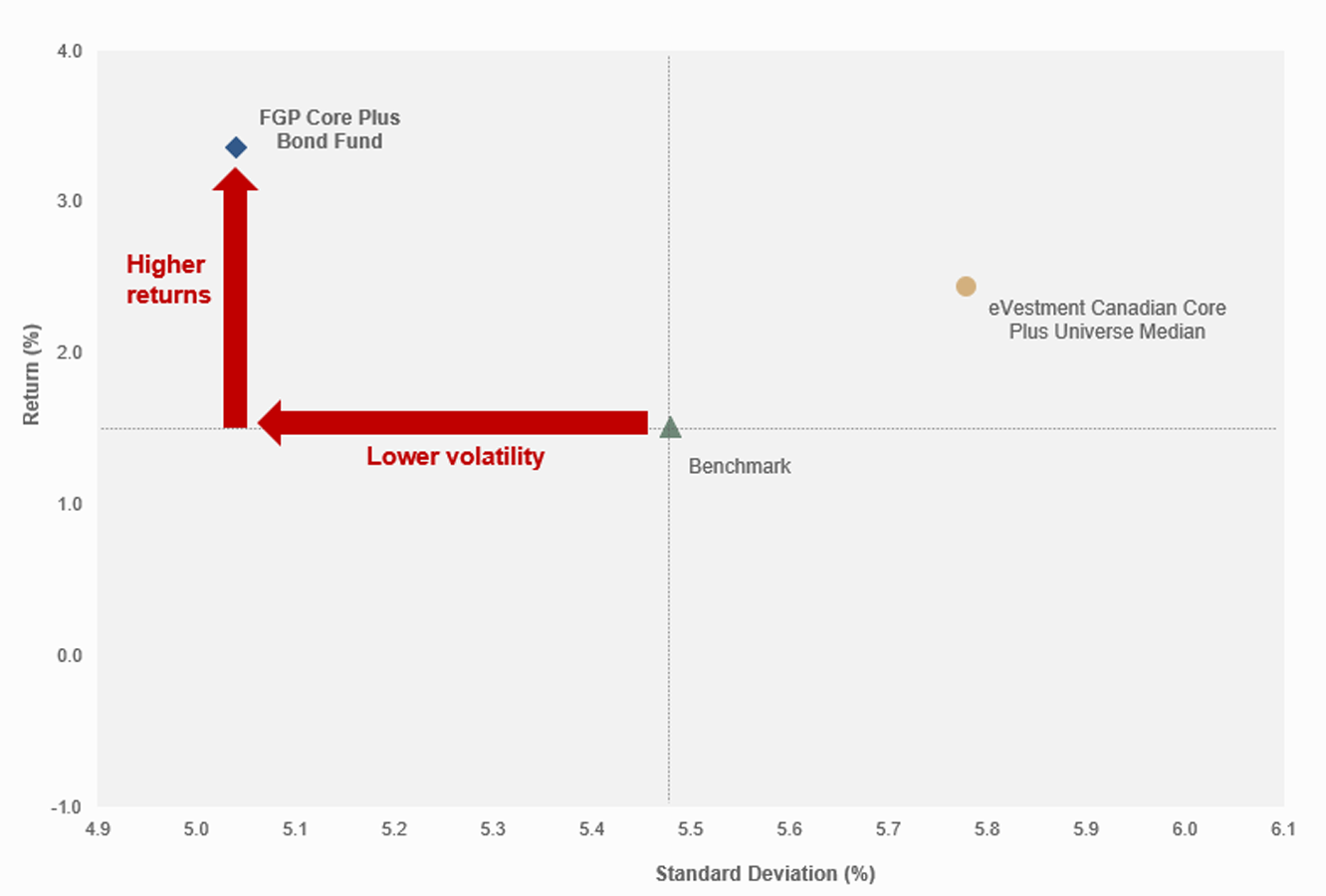

Expertise in credit analysis is a core competency of our Fixed Income team. The FGP Core Plus+ Bond Fund leverages this competitive advantage to create an investment solution that improves risk and return metrics of a universe bond solution. This is accomplished by investing in a core of federal, provincial, municipal, and investment grade corporate bonds while utilizing greater flexibility in allocations to each segment. Additionally, this solution further improves the risk and return profile by opportunistically adding “Plus” components such as high yield bonds, hybrids (bonds and preferred shares), convertibles, and foreign bonds.

|

|

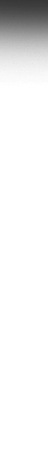

Top Decile Since Inception (Dec 31, 2015) |

|

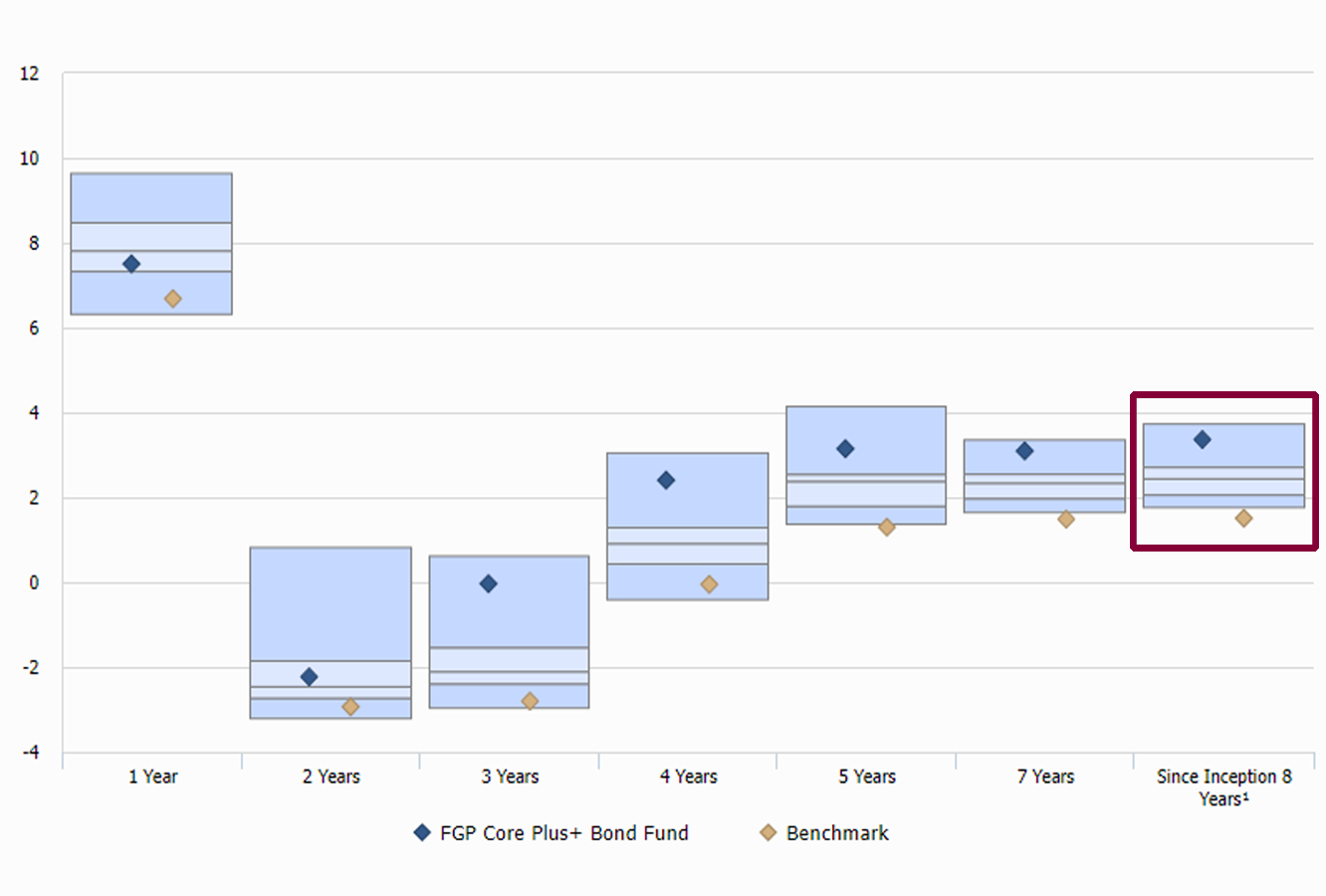

Superior Risk Adjusted Returns |

|

|

|

| Added Sources of Value | ||||

|

Not intended to solicit investment in the fund by anyone outside of Canada.

Our FGP Core Plus model includes, among other types of securities, preferred shares and convertible bonds. The preferred shares yield set dividends but also confer an ownership interest in the issuer. Convertible bonds may be converted (on terms and conditions) to equity stock which confers an ownership interest in the issuer.

top

top